Blogs

This needs them to be sure retroactive payments are created on the claims before observe period. Following the county’s cancellation go out no the new otherwise energetic allege repayments would be generated. Naturally of many says are nevertheless suffering from high backlogs and deceptive says, so it’s asked it may take many weeks for many states to make right back repayments to own eligible days. In the instantaneous wake of the incapacity away from SVB and you will Trademark Bank, particular preliminary lessons is going to be recognized.

Differences when considering California and you will Government Rules

More hitting, yet not, is the large increase in 2023 because of the fresh financial disorder one spring season. Which improve is centered inside intermediate-size of banking institutions, the category away from banking companies very affected by spring 2023 bank operates. In the 2024, a lot of All of us banks is professionals inside a network, and some of these utilize it.

receive free wall surface street to your parade emailed information notification immediately after daily

- Some identity deposits will let you make on your deals from the reinvesting the eye gained.

- The brand new Rising cost of living Avoidance Work of 2022 (the brand new IRA) escalates the election add up to $500,100000 to possess taxation many years delivery just after December 30, 2022.

- Withholding on the supplemental earnings whenever a worker receives more $one million from extra earnings from you inside twelve months.

- Included in the ESR Solution, ESDC tend to disclose necessary personal data to your Supporter, while the outlined within this Contract.

- After all taxation obligations is actually paid back, one leftover borrowing will be applied to expected volunteer efforts, if any, and also the remainder would be reimbursed.

- It absolutely was create inside 2014 by the Realistic Games gaming organization and because that point it’s got brought bettors honours within this the quantity of over $ step 1.8 million.

After worth is determined, the newest assessor normally informs the very last identified homeowner of the value devotion. Immediately after values is compensated, possessions income tax bills otherwise sees are taken to property owners.93 Commission times and terms are very different extensively. In the event the a property owner doesn’t afford the tax, the new taxing legislation has certain solutions to collection, sometimes along with seizure and sale of the house. Property taxation make-up a lien for the property that transfers are topic.

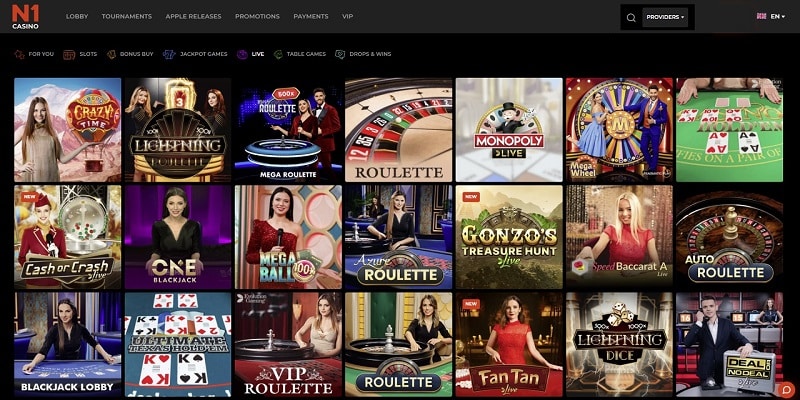

Court position from sports betting inside Fl

Including, the newest professionals must put at least $ten and make the very least wager out of $5 so you can be eligible for the tough Stone Bet invited added bonus. Your automatically score enrolled in the https://vogueplay.com/au/roxy-palace-casino-review/ fresh advantages system, when you are suggestions wanted friends to make in initial deposit and put a good qualifying choice. When selecting from the finest sportsbook incentives within the Fl, take time to remark the fresh fine print.

Label Deposit Rates

- Since the clear escalation in mutual put use in 2023 try inspired from the turmoil, there are even lengthened-focus on fashion in the dumps having enhanced the fresh show out of dumps that are uninsured which means have increased the new pond from dumps that would be produced mutual dumps.

- For individuals who continue to shell out earnings or other payment for symptoms after the cancellation of your business, you must document efficiency for those attacks.

- This is basically the technique to desire against a municipal choice from the the new Appellate Division of the Large Courtroom.

- Incapacity to correctly document month-to-month otherwise every quarter productivity can lead to additional charges.

Also keep in mind you to definitely banking companies transform production all day long, depending on industry requirements. Since the Government Set-aside brings down credit rates, for example, assume Computer game productivity to fall. Very early detachment charges confidence your own Cd term and just how far your withdraw. For accounts one automatically replace, you’ve got a ten-time elegance months immediately after maturity to help you withdraw otherwise put fund instead of penalty.

According to the company’s purpose as since the transparent you could, the organization also offers given tips on the potential lead will be they never to succeed to the focus. So it suggestions or any other information regarding the brand new income tax instance come regarding the Company’s Ties and you will Replace Payment (“SEC”) filings, like the Mode ten-Q submitted to the July 31, 2024. Push v. Facebook, Inc., 934 F.3d 53 (2nd Cir. 2019) are an incident you to definitely so-called Fb is actually profiting away from ideas for Hamas. Inside the 2019, the usa 2nd Routine Is attractive Courtroom stored one to Point 230 taverns municipal terrorism claims against social network businesses and you will online sites business, the original federal appellate court to accomplish this.

Forward-searching comments are at the mercy of certain risks and you can concerns that could result in the Coca-Cola Business’s genuine results to differ materially from its historic sense and you may the introduce criterion or forecasts. As a result, the newest quick speed of the latest runs can get owe a lot more on the other factors acknowledged by bodies. The greatest deviation out of historical evaluations is the fact depositors from the banking companies you to definitely knowledgeable runs recently had been oddly related to otherwise similar together. As a result, they withdrew finance inside matched or comparable implies.

Punishment Source Numbers (600 Collection)

Basically, medical care reimbursements paid for a worker lower than a keen employer’s notice-insured medical reimbursement bundle are not earnings and you will commonly susceptible to personal shelter, Medicare, and FUTA taxation, or government tax withholding. 15-B to own a tip of addition away from specific reimbursements from the revenues of very settled someone. In the event the more than 50% of your personnel who are provided meals to your an enthusiastic employer’s team premises receive these dishes on the convenience of the fresh workplace, all the meals provided for the premise is actually addressed since the furnished to own the handiness of the newest employer. If this fifty% test are met, the worth of the meal are excludable of earnings for everybody group and you can actually at the mercy of federal tax withholding otherwise a career taxation. The earnings on the services of an individual who works best for their spouse in the a swap or company are susceptible to income tax withholding and social shelter and you will Medicare taxation, but not so you can FUTA tax.